Why Should You Refinance a Mortgage?

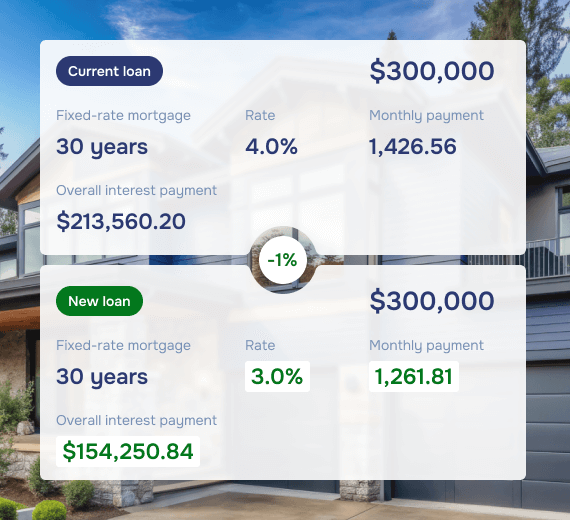

Refinancing a mortgage involves replacing it with a new contract. Your mortgage balance from the current loan will be paid off, and your new loan will go into effect. A mortgage refinance can be done through your original lender, or a new lender of your choice.

Depending on the type of loan you have, you may be able to qualify for a streamlined refinance, which requires less documentation and may not even require an appraisal. You may also be able to roll closing costs into your new loan amount for a no-cost refinance.

Get Started