No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

Buying a home in Washington is an exciting time, but it’s also a very in-depth and detailed one that takes a lot of steps to take you from your initial home visits to sealing the deal and getting the keys.

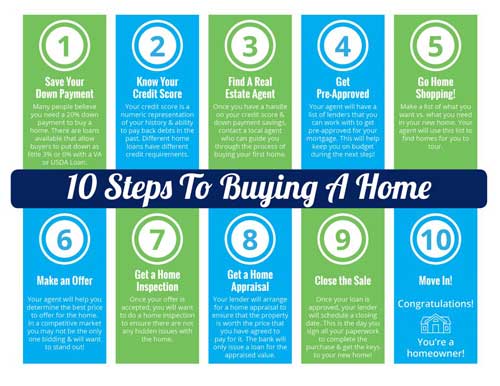

There are some things you need to do even before you start house hunting, such as start saving for a down payment, understand and boost your credit score, find a real estate agent and mortgage broker, and get pre-approved for a mortgage. Once you find the one you want and put in an offer, you’ll then need to get a home inspection and home appraisal, then close the sale and move in!

But all this takes some outside help in the form of a seasoned real estate agent and mortgage specialist. This infographic will outline every step needed to start and finish the home buying process. Click to Download PDF

You’ll likely need to take out a mortgage to help you finance your home purchase. But part of securing a mortgage means contributing a portion of the purchase price in the form of a down payment. This can cost you thousands of dollars, and the higher the purchase price of your home, the more you’ll have to put forward.

As such, it would be wise to take some time and make an effort to save up a few thousand dollars as a down payment before you begin the hunt for a new home.

Your lender will assess a few key traits before agreeing to approve you for a home loan, and your credit score is one of them. Your credit score will not only determine whether or not you can get approved for a mortgage, but it will also determine your interest rate.

The lower your rate, the better, as it can save you quite a bit of money over the long run. Understanding what your credit score is will allow you to determine whether or not improvements should be made to your score before you apply for a mortgage.

Having an experienced local real estate agent in your corner will help you find the right home for you that meets your needs and fits well within your budget. So start looking around for an agent that understands the local market and will work closely with you to find your dream home.

Before you start searching for a home, get pre-approved for a mortgage. This will allow you to figure out exactly how much you can get approved for, and therefore how much house you can afford. With that price point in mind, you’ll be better able to narrow your searches and focus only on properties that fit your financial criteria.

With a clear-cut budget in mind and a list of needs and wants, you’re now ready to start looking for your new home!

Once you find the home of your dreams, put in an offer. Your real estate agent will work with you to draft up a solid offer that will capture the seller’s attention and boost your odds of offer acceptance.

Before you agree to buy a home, have a professional inspect it thoroughly first. That way, if you discover any major issues with the home, you’ll have the chance to either renegotiate a lower price, request a credit to cover the cost of repairs, ask the seller to make the necessary repairs, or walk away from the deal altogether.

Your lender will want the home you agreed to buy appraised to verify its actual current market value. That way, the lender can make sure that the price you agreed to pay is what the home is truly worth. If not, the lender will be at greater risk. An appraisal will put the lender at ease knowing that the purchase price reflects the market value of the hme.

After the offer has been accepted and all contingencies have either been fulfilled or waived, the deal is done! The home is now yours!

Once you get the keys to your new home, you’re ready to move in all your belongings and start building memories in your new place!

If you’d like to learn more about the home buying process, mortgage rates, mortgage programs, or other related topics, don’t hesitate to reach out to the professionals at Sammamish Mortgage today! Sammamish Mortgage is a family-owned mortgage company with over 25 years of experience delivering mortgage loans to customers in the Pacific Northwest at competitive interest rates. States include WA, OR, CO & ID. Contact us to learn more, you can also View Rates, get a Rate Quote, or Apply Now using our new online automated mortgage application system!

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.