No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

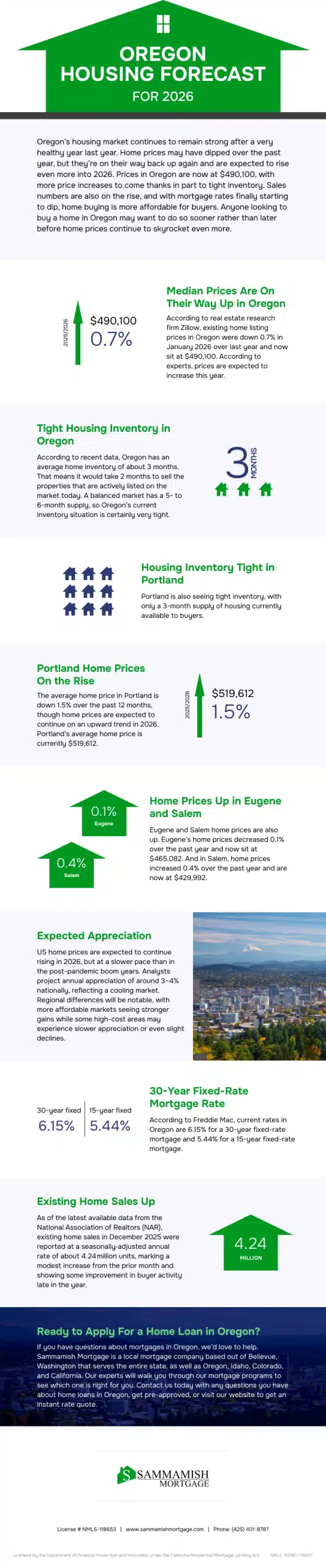

Oregon’s housing market continues to remain strong after a very healthy year last year. Home prices may have dipped over the past year, but they’re on their way back up again and are expected to rise even more into 2026. Prices in Oregon are now at $490,100, with more price increases to come thanks in part to tight inventory. Sales numbers are also on the rise, and with mortgage rates finally starting to dip, home buying is more affordable for buyers. Anyone looking to buy a home in Oregon may want to do so sooner rather than later before home prices continue to skyrocket even more.

According to real estate research firm Zillow, existing home listing prices in Oregon were down 0.7% in January 2026 over last year and now sit at $490,100. According to experts, prices are expected to increase this year.

According to recent data, Oregon has an average home inventory of about 3 months. That means it would take 2 months to sell the properties that are actively listed on the market today. A balanced market has a 5- to 6-month supply, so Oregon’s current inventory situation is certainly very tight.

Portland is also seeing tight inventory, with only a 3-month supply of housing currently available to buyers.

The average home price in Portland is down 1.5% over the past 12 months, though home prices are expected to continue on an upward trend in 2026. Portland’s average home price is currently $519,612.

Eugene and Salem home prices are also up. Eugene’s home prices decreased 0.1% over the past year and now sit at $465,082. And in Salem, home prices increased 0.4% over the past year and are now at $429,992.

According to Freddie Mac, current rates in Oregon are 6.15% for a 30-year fixed-rate mortgage and 5.44% for a 15-year fixed-rate mortgage.

US home prices are expected to continue rising in 2026, but at a slower pace than in the post-pandemic boom years. Analysts project annual appreciation of around 3–4% nationally, reflecting a cooling market. Regional differences will be notable, with more affordable markets seeing stronger gains while some high-cost areas may experience slower appreciation or even slight declines.

As of the latest available data from the National Association of Realtors (NAR), existing home sales in December 2025 were reported at a seasonally‑adjusted annual rate of about 4.24 million units, marking a modest increase from the prior month and showing some improvement in buyer activity late in the year.

If you have questions about mortgages in Oregon, we’d love to help. Sammamish Mortgage is a local mortgage company based out of Bellevue, Washington that serves the entire state, as well as Oregon, Idaho, Colorado, and California. Our experts will walk you through our mortgage programs to see which one is right for you. Contact us today with any questions you have about home loans in Oregon, get pre-approved, or visit our website to get an instant rate quote.

Whether you’re buying a home or ready to refinance, our professionals can help.

Mortgage Support — 24/7

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

Adjust the parameters based on what you want to track