No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

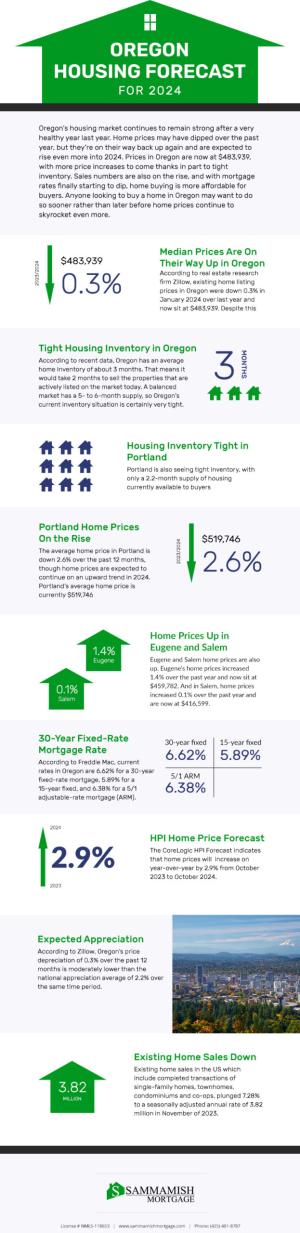

Oregon’s housing market continues to remain strong after a very healthy year last year. Home prices may have dipped over the past year, but they’re on their way back up again and are expected to rise even more into 2024. Prices in Oregon are now at $483,939, with more price increases to come thanks in part to tight inventory. Sales numbers are also on the rise, and with mortgage rates finally starting to dip, home buying is more affordable for buyers. Anyone looking to buy a home in Oregon may want to do so sooner rather than later before home prices continue to skyrocket even more.

According to real estate research firm Zillow, existing home listing prices in Oregon were down 0.3% in January 2024 over last year and now sit at $483,939. Despite this decline, prices are expected to increase this year.

According to recent data, Oregon has an average home inventory of about 3 months. That means it would take 2 months to sell the properties that are actively listed on the market today. A balanced market has a 5- to 6-month supply, so Oregon’s current inventory situation is certainly very tight.

Portland is also seeing tight inventory, with only a 2.2-month supply of housing currently available to buyers.

The average home price in Portland is down 2.6% over the past 12 months, though home prices are expected to continue on an upward trend in 2024. Portland’s average home price is currently $519,746.

Eugene and Salem home prices are also up. Eugene’s home prices increased 1.4% over the past year and now sit at $459,782. And in Salem, home prices increased 0.1% over the past year and are now at $416,599.

According to Freddie Mac, current rates in Oregon are 6.62% for a 30-year fixed-rate mortgage, 5.89% for a 15-year fixed, and 6.38% for a 5/1 adjustable-rate mortgage (ARM).

The CoreLogic HPI Forecast indicates that home prices will increase on year-over-year by 2.9% from October 2023 to October 2024.

According to Zillow, Oregon’s price depreciation of 0.3% over the past 12 months is moderately lower than the national appreciation average of 2.2% over the same time period.

Existing home sales in the US which include completed transactions of single-family homes, townhomes, condominiums and co-ops, plunged 7.28% to a seasonally adjusted annual rate of 3.82 million in November of 2023.

If you have questions about mortgages in Oregon, we’d love to help. Sammamish Mortgage is a local mortgage company based out of Bellevue, Washington that serves the entire state, as well as Oregon, Idaho, and Colorado. Our experts will walk you through our mortgage programs to see which one is right for you. Contact us today with any questions you have about home loans in Oregon.

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.