A Cash-Out Refinance Can Help With Your Financial Needs!

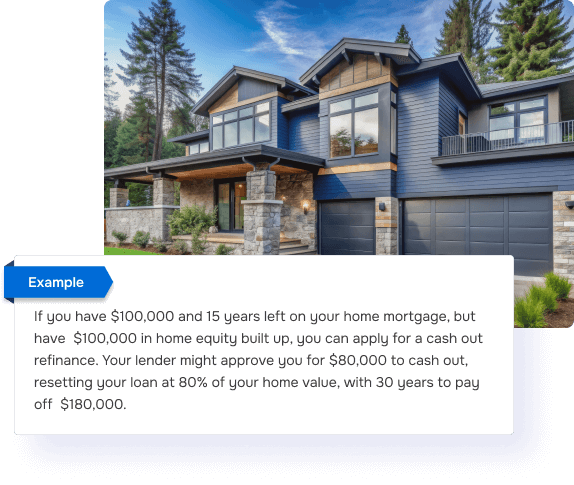

Use your home equity to your advantage! Get money out of your home and use it for anything you want. Find out if it makes sense to refinance with our Refinance Calculator.

Make home improvements to increase the value of your home, pay for college tuition, pay off high-interest credit card debt, or buy a vacation home.

We’ve helped hundreds of Americans, just like you, lower their monthly payment by refinancing. Contact us today to see how we can help you!

Get Started