No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

Some home buyers in Washington and Oregon have to pay for private mortgage insurance, while others do not. Why is this true? It has to do with the size of the down payment, and the resulting loan-to-value ratio. Let’s start with a basic definition of PMI:

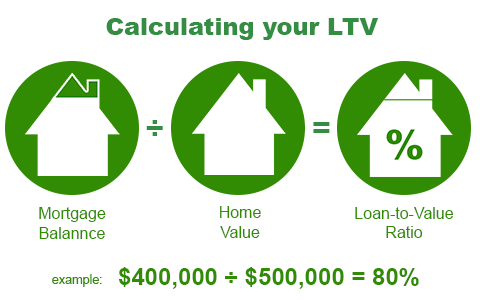

Definition: Private mortgage insurance (PMI) is a special kind of policy that protects mortgage lenders from losses that can occur if a borrower stops making payments on the loan. PMI policies are usually required when a person buys a house with a down payment below 20%. This results in a loan-to-value (LTV) ratio above 80%, which is the threshold for PMI.

PMI premiums are added to the borrower’s monthly loan payments. This means that home buyers with private mortgage insurance end up with higher monthly payments than those who do not need PMI (with all other things being equal). For a conventional loan, private mortgage insurance can usually be canceled when the LTV ratio drops to 80% or below.

When it comes to PMI, conventional wisdom is that you either pay it or you don’t. Borrowers who make smaller down payments (and end up with a loan-to-value ratio above 80%) almost always have to pay for PMI. On the other, home buyers who make larger down payments can avoid it altogether.

But there’s some middle ground here. For those borrowers in Washington and Oregon who do have to pay PMI, it’s often possible to qualify for a lower insurance premium. This reduces the overall cost of the policy.

Sammamish Mortgage works with a number of investors. This allows us to offer a wide variety of mortgage loan products to our customers, many of which have flexible qualification criteria. One of our larger investors has negotiated reduced PMI premiums that are lower than many of our competitors.

The bottom line: If you can’t afford a 20% down payment when buying a home in Washington or Oregon, there’s a good chance you’ll have to pay for private mortgage insurance. But not all PMI policies are the same. The costs can vary do to a number of factors. We are able to offer some of the lowest PMI premiums you’ll find in Washington or Oregon.

Request a free, no-obligation mortgage consultation to learn more about what programs might work for you.

Private mortgage insurance has been around for many years. In fact, the concept dates back to the late 1800s, with the first laws being passed in the early 1900s.

The mortgage insurance industry essentially collapsed during the Great Depression (like so many other businesses and industries), but it was “reborn” in the 1950s. In 1961, the state of California passed a law that standardized and regulated the industry, and this became the model for other states as well.

The modern version of private mortgage insurance is actually a good thing for home buyers. While it does increase the monthly payments by a small amount, it also makes homeownership possible for a much larger group of buyers. Without PMI protections, the small down-payment programs available today would all but vanish.

Do you have questions about home loans? Are you ready to apply for a mortgage to buy a home? If so, Sammamish Mortgage can help. We are a local mortgage company from Bellevue, Washington serving the entire state, as well as Oregon, Idaho, and Colorado. We offer many mortgage programs to buyers all over the Pacific Northwest. Contact us today with any questions you have about mortgages.

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.