Ammon Mortgage Lenders

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

* $800,000 | 30-Yr-fixed | Credit Score 800+ | 25% Down Payment

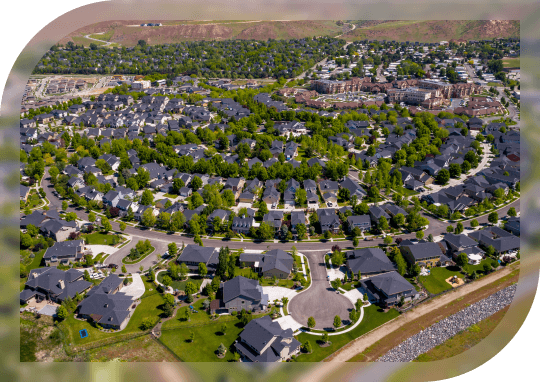

Ammon, Idaho, located just east of Idaho Falls, is a fast-growing city offering a quiet, suburban feel with access to great schools, parks, and shopping. Its combination of affordability and quality of life makes it an appealing option for first-time buyers and families alike. Sammamish Mortgage offers flexible loan solutions to help you finance your future in Ammon.

Your mortgage rate in Ammon depends on a range of personal and market-related factors, including:

Current economic and interest rate conditions

Down payment amount and home price

Credit score and borrowing history

Type of loan and repayment term

Loan fees and estimated closing costs

Our experienced team will work with you to navigate these variables and find the most affordable rate available for your circumstances.

With more than 30 years of mortgage industry expertise, Sammamish Mortgage offers personalized service, low rates, and efficient processing. We’re committed to helping Idaho buyers and homeowners reach their goals with a smooth, transparent lending experience.

Ammon’s real estate market offers a mix of new developments, family-friendly neighborhoods, and rural-style homes on larger lots. With its convenient location and increasing amenities, Ammon is perfect for anyone seeking comfort and growth potential in Eastern Idaho.

At Sammamish Mortgage, we provide a full suite of mortgage products designed for Ammon homebuyers. Whether you’re looking for the consistency of a 30-year fixed-rate mortgage, the low-down-payment benefits of an FHA loan, eligibility for VA loan programs, or the financing power of a jumbo loan, we’ll find the right fit for your needs.

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

Ammon borrowers have multiple loan options when it comes to getting their hands on a real estate loan. Here are some of the most popular home mortgage loan programs:

30-year fixed-rate conventional loans provide Idaho home buyers with a low monthly mortgage payment in exchange for more total interest paid over the life of the loan.

Veterans, active duty military, or surviving spouses of service members may be able to get a VA loan with a low down payment or no down payment at all.

If you have a low income or are a first-time home buyer, an FHA loan might help you buy a home sooner than you expected. You’ll be able to take advantage of flexibility when it comes to your down payment and credit score and may also be able to qualify for closing cost assistance.

Living in an expensive zip code may make you think you’ll have to rent forever. However, a jumbo loan can be right for you if your chosen neighborhood has homes priced over conventional loan limits.

You can buy a home with as little as 3% down through conventional loans or 0% with VA and USDA programs.

Most home loans close within 30 to 45 days, depending on your lender and documentation readiness.

Yes, refinancing is available to reduce your interest rate or access home equity.

Buyers can choose from conventional, FHA, VA, and USDA loans, as well as jumbo or adjustable-rate mortgages.

Yes, USDA and VA loans both offer 0% down financing for qualified borrowers.

Most lenders allow you to lock in your rate for 30 to 60 days while your loan is processed.

It depends on your personal financial situation and market predictions.

Yes, strong employment can lead to more favorable lending conditions.

Lower DTI ratios typically qualify for better rates.

Yes, but jumbo loans usually have higher interest rates than conforming loans.

Work with a seasoned lender like Sammamish Mortgage. We help Idaho homebuyers by offering transparent, low-fee home loans with personalized guidance and fast pre-approvals.

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

Adjust the parameters based on what you want to track