Eagle Mortgage Lenders

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

* $800,000 | 30-Yr-fixed | Credit Score 800+ | 25% Down Payment

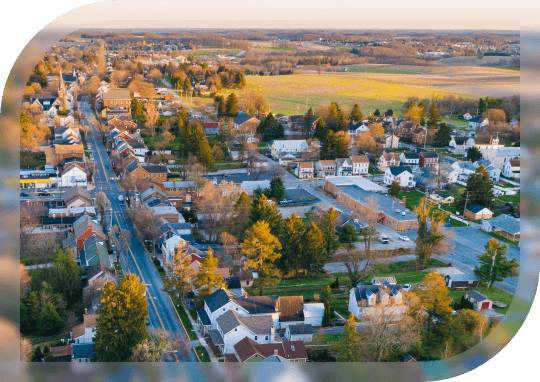

Begin your homeownership journey in Eagle with a trusted mortgage partner who understands the local landscape. For over 30 years, Sammamish Mortgage has been helping residents of Eagle find the ideal homes and secure a great financing option. Known for its picturesque river views and vibrant agricultural roots, Eagle blends rural serenity with modern suburban living. Our team is committed to providing personalized guidance, ensuring you make informed decisions as you navigate your mortgage journey.

As you explore Eagle’s dynamic real estate market, it’s important to recognize the factors that influence mortgage rates:

To secure the most affordable possible mortgage terms in Eagle, it’s essential to work with a lender who values honesty and transparency. At Sammamish Mortgage, our Loan Officers are dedicated to offering unbiased advice tailored to your financial needs, helping you navigate the mortgage process without any pressure.

Eagle’s real estate options range from charming historic homes in quiet neighborhoods to newly constructed properties in developing areas. Whether you’re looking for a spacious family home or a peaceful countryside retreat, Eagle offers a variety of homes to fit every buyer’s needs.

We offer a variety of loan programs designed to meet the needs of Eagle’s homebuyers. Whether you’re purchasing your first home, refinancing, or looking for specialized financing, our customized solutions are built to help you secure the most affordable possible terms.

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

Eagle borrowers have multiple loan options when it comes to getting their hands on a real estate loan. Here are some of the most popular home mortgage loan programs:

30-year fixed-rate conventional loans provide Idaho home buyers with a low monthly mortgage payment in exchange for more total interest paid over the life of the loan.

Veterans, active duty military, or surviving spouses of service members may be able to get a VA loan with a low down payment or no down payment at all.

If you have a low income or are a first-time home buyer, an FHA loan might help you buy a home sooner than you expected. You’ll be able to take advantage of flexibility when it comes to your down payment and credit score and may also be able to qualify for closing cost assistance.

Living in an expensive zip code may make you think you’ll have to rent forever. However, a jumbo loan can be right for you if your chosen neighborhood has homes priced over conventional loan limits.

The mortgage process begins with a conversation about your financial profile with a Loan Officer. You will complete a mortgage application and provide supporting documents such as income verification, bank statements, and credit information. Once submitted, your loan moves through processing and underwriting before reaching final approval and closing.

Mortgage pre-approval occurs when a lender reviews your financial information to determine an estimated loan amount you may qualify for. This helps you focus your home search within a realistic budget and signals to sellers and real estate agents that you are financially prepared, which can strengthen your offer.

Homebuyers in Eagle have access to a range of mortgage programs. Conventional loans are commonly used, while government-backed options such as FHA loans may offer additional flexibility for credit and down payment requirements. USDA loans may be available for eligible properties, and VA loans are designed to support qualifying veterans and active-duty service members.

Closing costs include expenses such as loan origination fees, appraisal costs, title insurance, escrow services, and prepaid items like homeowners insurance and property taxes. The total amount varies based on loan type and transaction details. Your Loan Officer can provide a detailed estimate so you can plan accordingly.

Lenders review your credit history to assess how you have managed credit obligations over time. Your credit report and score are key components of the underwriting process for most loan programs. Reviewing your credit in advance allows you to address potential issues before applying.

Many mortgage programs allow documented gift funds from family members or approved sources to be used toward down payments or closing costs. Lenders typically require a gift letter and supporting documentation to confirm the funds are a gift and not a repayment obligation.

An appraisal is an independent assessment of a property’s market value performed by a licensed appraiser. Lenders require appraisals to confirm that the home’s value supports the loan amount. If the appraised value is lower than the purchase price, further negotiation or adjustments may be needed.

An escrow account is used to collect and hold funds for recurring housing-related expenses such as property taxes, homeowners insurance, and any required mortgage insurance. These amounts are included in your monthly payment and paid on your behalf when due.

After a purchase agreement is signed, closing on a home loan typically takes between 30 and 60 days. The timeline depends on factors such as appraisal completion, underwriting review, inspections, and timely document submission. Prompt communication helps keep the process moving smoothly.

Yes. Refinancing allows homeowners to revisit their mortgage terms after purchase. This may involve changing loan types, adjusting the loan structure, or accessing home equity for other financial needs. A mortgage professional can help evaluate whether refinancing aligns with your current goals and circumstances.

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.