Twin Falls Mortgage Lenders

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

* $800,000 | 30-Yr-fixed | Credit Score 800+ | 25% Down Payment

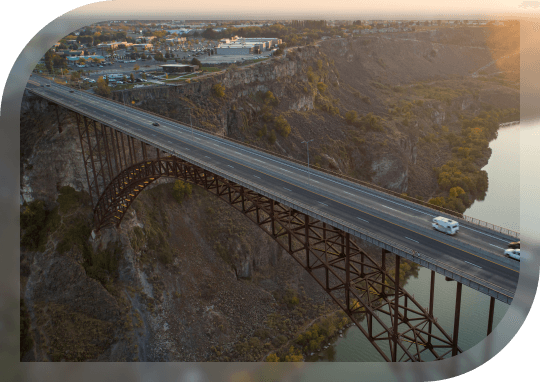

Begin your journey to homeownership in Twin Falls with a trusted mortgage partner who understands the local landscape. For over 30 years, Sammamish Mortgage has been helping Twin Falls residents secure the perfect homes. With its rich agricultural roots and breathtaking views along the Snake River, Twin Falls offers a blend of rural charm and modern suburban living that we understand deeply. Our mission is to provide you with personalized support and expert mortgage guidance throughout every step of the process.

When diving into Twin Falls’s real estate market, be mindful of factors that can impact mortgage rates:

To secure the greatest possible mortgage rate in Twin Falls, it’s important to partner with a lender who values your interests. At Sammamish Mortgage, our Loan Officers offer clear, unbiased guidance, ensuring you get solutions that align with your financial goals, without any pressure.

Whether you’re drawn to historic homes or new developments, Twin Falls offers a wide variety of housing options. From family-friendly properties near schools to serene countryside retreats, the local real estate market provides something for everyone.

Our array of loan programs is designed to meet the unique needs of Twin Falls homebuyers. Whether you’re a first-time homebuyer or refinancing an existing property, we offer flexible, tailored mortgage solutions to help you find the right home at the most optimal possible terms.

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

Twin Falls borrowers have multiple loan options when it comes to getting their hands on a real estate loan. Here are some of the most popular home mortgage loan programs:

30-year fixed-rate conventional loans provide Idaho home buyers with a low monthly mortgage payment in exchange for more total interest paid over the life of the loan.

Veterans, active duty military, or surviving spouses of service members may be able to get a VA loan with a low down payment or no down payment at all.

If you have a low income or are a first-time home buyer, an FHA loan might help you buy a home sooner than you expected. You’ll be able to take advantage of flexibility when it comes to your down payment and credit score and may also be able to qualify for closing cost assistance.

Living in an expensive zip code may make you think you’ll have to rent forever. However, a jumbo loan can be right for you if your chosen neighborhood has homes priced over conventional loan limits.

Single-family homes make up most transactions, though townhomes and condos are also listed.

Factors include population growth, migration, affordability relative to other regions, and limited supply.

They are not very common in Twin Falls currently. Homes generally sell near or slightly below list.

Home prices in Twin Falls are below many coastal or urban markets, making it relatively more affordable.

Yes—rural areas often see lower prices, slower turnover, and less competition.

Conventional loans often require credit scores of 620+ and down payments of 3% to 5% (with PMI if less than 20%).

Lenders often allow DTI up to 43%, though stricter underwriting may require lower DTI.

Yes — self-employed buyers may need additional documentation (tax returns, profit/loss statements).

Refinancing often has slightly higher rates or additional fees; your credit, loan-to-value, and market conditions also matter.

Yes, jumbo loans are available for higher-priced homes where loan amounts exceed conforming loan limits in Idaho.

It depends on the ARM product. For example, 5/1 ARM adjusts annually after first fixed period, with caps on yearly increases and lifetime ceilings.

Yes, in some subdivisions or planned communities there are HOA fees, varying widely by development.

Typically up to 45 days from offer acceptance to closing, depending on appraisal, inspection, and underwriting.

Plan for a down payment of 3% to 20% (depending on loan), plus closing costs, inspections, and reserve funds for maintenance.

Signs of a buyer’s market include increased days on the market, more price reductions, fewer bids above asking, and rising inventory.

Sammamish Mortgage offers local expertise with personalized service from loan officers who understand the unique dynamics of markets in Idaho. We offer competitive rates and transparent pricing with no hidden fees, and a streamlined digital experience for the ultimate in convenience.

Whether you’re buying a home or ready to refinance, our professionals can help.

Mortgage Support — 24/7

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

Adjust the parameters based on what you want to track