Blackfoot Mortgage Lenders

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

* $800,000 | 30-Yr-fixed | Credit Score 800+ | 25% Down Payment

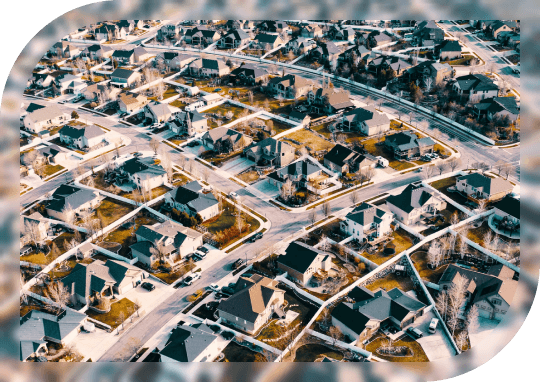

Blackfoot, often referred to as the “Potato Capital of the World,” offers small-town living with big charm. Its welcoming community, affordable housing, and central location between Pocatello and Idaho Falls make it a great place to raise a family or settle into a quieter lifestyle. Sammamish Mortgage is here to help you finance your home in this down-to-earth Idaho city.

Mortgage rates in Blackfoot depend on both market and borrower-specific factors, such as:

Federal interest rate trends and lender pricing

Down payment size and credit score

Type and term of the loan

Loan-to-value ratio

Estimated closing costs and fees

We’ll help you understand these factors and secure a competitive rate that aligns with your goals.

With more than 30 years of experience, Sammamish Mortgage is committed to delivering a transparent, efficient mortgage process. Our dedicated advisors provide step-by-step guidance whether you’re a first-time buyer, a repeat homeowner, or someone looking to refinance into a better loan.

Blackfoot features a mix of single-family homes, rural properties, and newer subdivisions. Its relatively low cost of living and growing amenities make it ideal for families and retirees seeking long-term value and livability in Southeastern Idaho.

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

Blackfoot borrowers have multiple loan options when it comes to getting their hands on a real estate loan. Here are some of the most popular home mortgage loan programs:

30-year fixed-rate conventional loans provide Idaho home buyers with a low monthly mortgage payment in exchange for more total interest paid over the life of the loan.

Veterans, active duty military, or surviving spouses of service members may be able to get a VA loan with a low down payment or no down payment at all.

If you have a low income or are a first-time home buyer, an FHA loan might help you buy a home sooner than you expected. You’ll be able to take advantage of flexibility when it comes to your down payment and credit score and may also be able to qualify for closing cost assistance.

Living in an expensive zip code may make you think you’ll have to rent forever. However, a jumbo loan can be right for you if your chosen neighborhood has homes priced over conventional loan limits.

To begin, you’ll meet with a Loan Officer to assess your financial profile, including income, employment, assets, and credit. After completing an application and submitting required documentation, your loan enters processing and underwriting. Once underwriting conditions are met, the loan moves toward closing.

Pre‑approval involves a lender verifying key financial information so you have a clearer understanding of your estimated borrowing ability. It also signals to sellers and real estate agents that you are financially prepared, which can improve your position when submitting offers.

Buyers in Blackfoot may consider a range of loan options. Common choices include conventional mortgages, FHA loans for borrowers with flexible down payment requirements, USDA loans for qualifying rural properties, and VA loans for eligible veterans and service members. Each loan type has specific eligibility criteria and documentation standards.

Closing costs include loan origination fees, appraisal charges, title and escrow fees, and prepaid expenses such as property taxes and insurance. While the total varies by loan program and local market conditions, many buyers plan for several thousand dollars. Your Loan Officer will provide a detailed estimate tailored to your situation.

Your credit history helps lenders assess your track record in managing debt. Underwriters review credit reports and scores as part of determining your qualification for different loan programs. Reviewing your credit early can help you address any issues before applying.

Yes. Many mortgage programs allow the use of documented gift funds from family members or approved sources to assist with down payment and closing costs. To qualify, you typically need to provide a gift letter and supporting documentation that confirms the funds are a true gift, not a loan.

An appraisal is an independent assessment of the property’s market value. Lenders require it to ensure the home’s value supports the loan amount. If the appraisal comes in below the agreed purchase price, you and the seller may negotiate adjustments, or you may consider other financing strategies.

An escrow account collects portions of your monthly mortgage payment to cover property taxes, homeowners insurance, and any applicable mortgage insurance. The lender or servicer manages the account and disburses payments as needed, helping ensure these obligations are paid on schedule.

Once your purchase agreement is signed, closing on a home loan usually takes between 30 and 60 days. This timeframe depends on factors such as appraisal scheduling, inspections, and timely submission of required documentation. Staying responsive throughout the process can help maintain momentum.

Yes. Refinancing allows you to revisit your mortgage terms after purchase, whether to adjust your loan structure, change your loan type, or access home equity for other needs. A mortgage professional can help evaluate your financial situation and determine whether refinancing aligns with your goals.

Whether you’re buying a home or ready to refinance, our professionals can help.

Mortgage Support — 24/7

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

Adjust the parameters based on what you want to track