Coeur d`Alene Mortgage Lenders

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

* $800,000 | 30-Yr-fixed | Credit Score 800+ | 25% Down Payment

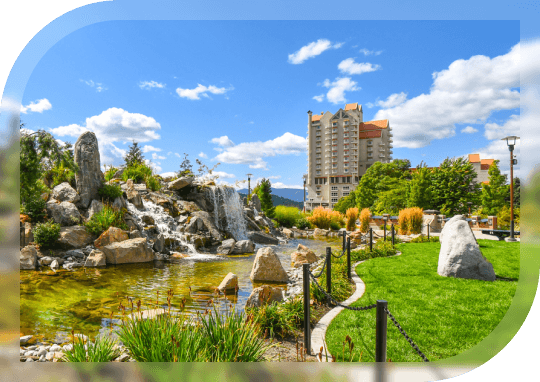

Begin your home-buying journey in Coeur d’Alene with confidence, backed by over three decades of mortgage expertise. Sammamish Mortgage has been aiding buyers in Coeur d’Alene by providing detailed insights and support through the mortgage process. Known for its stunning lake views and vibrant outdoor lifestyle, Coeur d’Alene offers a unique blend of natural beauty and community spirit. Our team is committed to tailoring our services to fit the local market dynamics and your individual needs.

As you consider entering the real estate market in Coeur d’Alene, it’s crucial to understand that mortgage rates can be influenced by various factors:

To secure a competitive mortgage rate in Coeur d’Alene, it’s essential to collaborate with a lender who prioritizes clear and honest communication. Our Loan Officers at Sammamish Mortgage are experts, dedicated to offering you advice that is right for your financial situation, not ours.

Coeur d’Alene’s housing market offers a variety of options, from waterfront properties to cozy, wooded retreats. The diverse real estate ensures there is a perfect match for everyone, whether you’re seeking a family home or a vacation getaway.

Our extensive range of loan programs in Coeur d’Alene is designed to meet the diverse needs of its residents. Whether you’re purchasing your first home or refinancing an existing one, we provide customized loan solutions to help you achieve your homeownership goals.

Want a transparent mortgage rate? You’ll need to work with a mortgage lender that has a reputation for transparency. This helps ensure the loan you get is right for you, not just the biggest one you qualify for.

Coeur d`Alene borrowers have multiple loan options when it comes to getting their hands on a real estate loan. Here are some of the most popular home mortgage loan programs:

30-year fixed-rate conventional loans provide Idaho home buyers with a low monthly mortgage payment in exchange for more total interest paid over the life of the loan.

Veterans, active duty military, or surviving spouses of service members may be able to get a VA loan with a low down payment or no down payment at all.

If you have a low income or are a first-time home buyer, an FHA loan might help you buy a home sooner than you expected. You’ll be able to take advantage of flexibility when it comes to your down payment and credit score and may also be able to qualify for closing cost assistance.

Living in an expensive zip code may make you think you’ll have to rent forever. However, a jumbo loan can be right for you if your chosen neighborhood has homes priced over conventional loan limits.

Mortgage rates in Coeur d’Alene vary by lender and credit score but generally align with national averages.

You’ll need a steady income, good credit, and a manageable debt-to-income ratio to qualify.

Most approvals take between 30 and 45 days, depending on your lender and documentation.

A score of 620 or higher is recommended for most loan programs, though FHA loans accept lower scores.

Rates are comparable statewide, but may differ slightly based on lender competition and market demand.

Yes, mortgage pre-approval estimates your borrowing power to show sellers that you’re a qualified borrower. It can also help speed up the final mortgage approval process when you find a home you love.

You’ll need pay stubs, tax returns, W-2s, and bank statements to complete your application.

Yes, with strong job growth, scenic views, and a vibrant community, it’s one of Idaho’s most desirable cities.

Fixed-rate loans keep the same interest rate for the term, while adjustable-rate loans change over time.

Yes, several lenders provide jumbo loans for high-value properties exceeding conforming loan limits.

Sammamish Mortgage offers a variety of home loan products, including conventional, FHA, VA, and jumbo loans for home buyers and homeowners. We provide competitive rates, an online mortgage process, and personalized service across the Pacific Northwest.

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

Adjust the parameters based on what you want to track